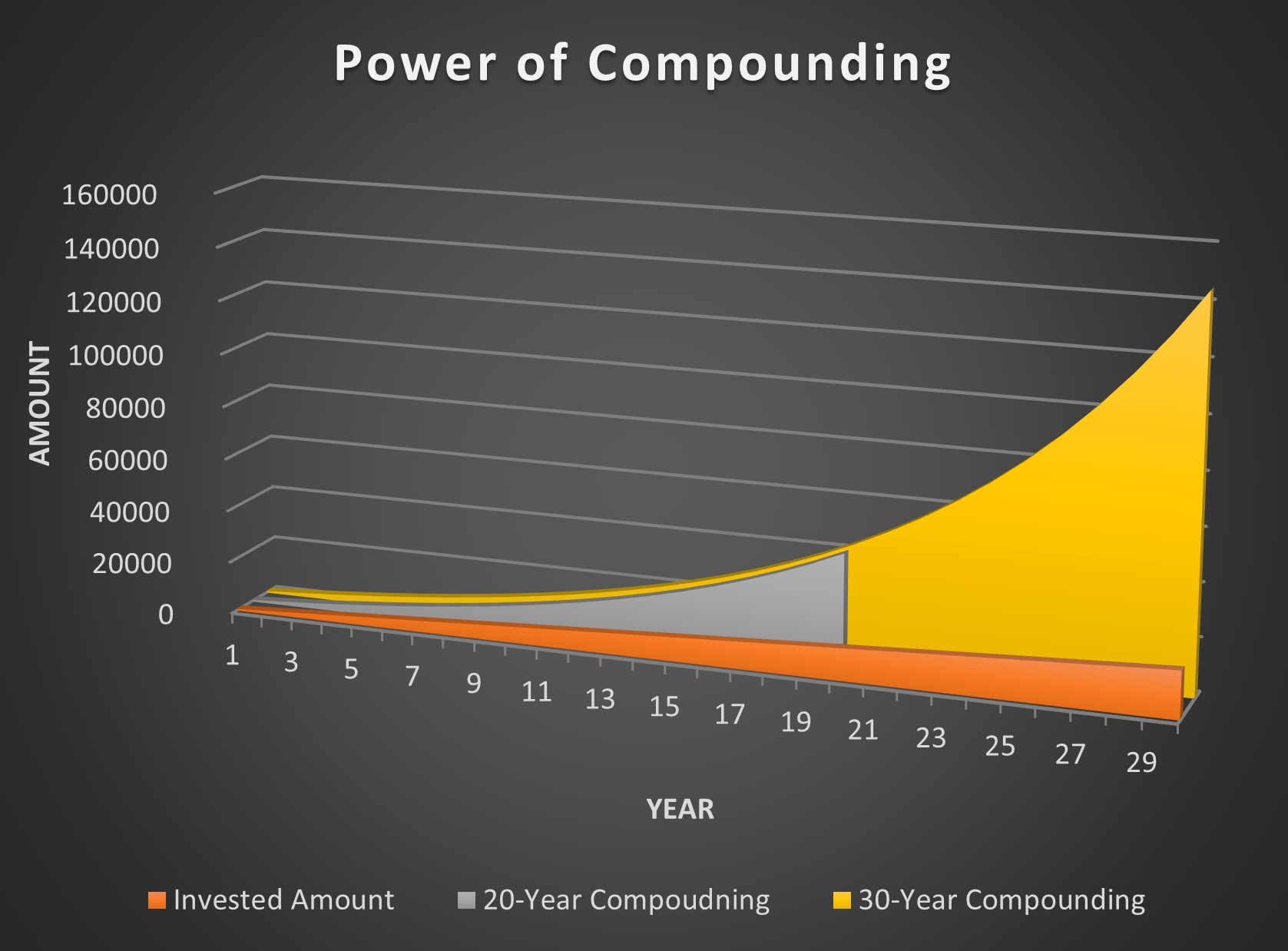

The Power of Compounding

Why should you start investing early? All this must be something to think about 10 years later when you have more money right? Wrong. The earlier you invest, however small the contribution, pays off in spades.

Here’s a little peep into the future of you at 50 depending on when you start investing…

Let’s say you start investing on your 20th birthday, you put in £50 every month at an annual interest rate, also known as Compound Annual Growth Rate (CAGR) of 12%. The important part of investing is to be consistent, so you continue this until you’re 50 years old. Seems like an eternity away, but it’ll be worth it. On your 50th birthday, you’d be set to receive £176,500! Even though the total amount invested is only £18,050.00, you’d have made £150,000 in interest alone.

In an alternate universe, you only hear about investing when you turn 30. You invest the same amount every month with the same interest rate. This time around, on your 50th birthday, you receive £43,000. An impressive amount, but you’ve paid the price for waiting 10 years.

That’s the power of compounding and starting early for you. In the 5 years you waited, your investment has nearly doubled!